Mandatory Requirements for Joint Venture Agreements in the SBA All Small Mentor-Protégé Program

The Small Business Administration (SBA) has established specific requirements for joint ventures, particularly under the auspices of the All Small Mentor-Protégé Program, as detailed in 13 CFR 125.8. This regulation establishes a comprehensive framework to ensure that such partnerships are formed and operated in accordance with federal objectives to support small business development and participation in federal procurement.

A joint venture, as defined in this context, is a business arrangement between two or more entities that collaborate to complete federal contracts. For a joint venture to be considered small and thus eligible to compete for contracts set aside or reserved for small businesses, each entity within the venture must individually meet the size standards applicable to the procurement in question, or meet specific affiliation exceptions.

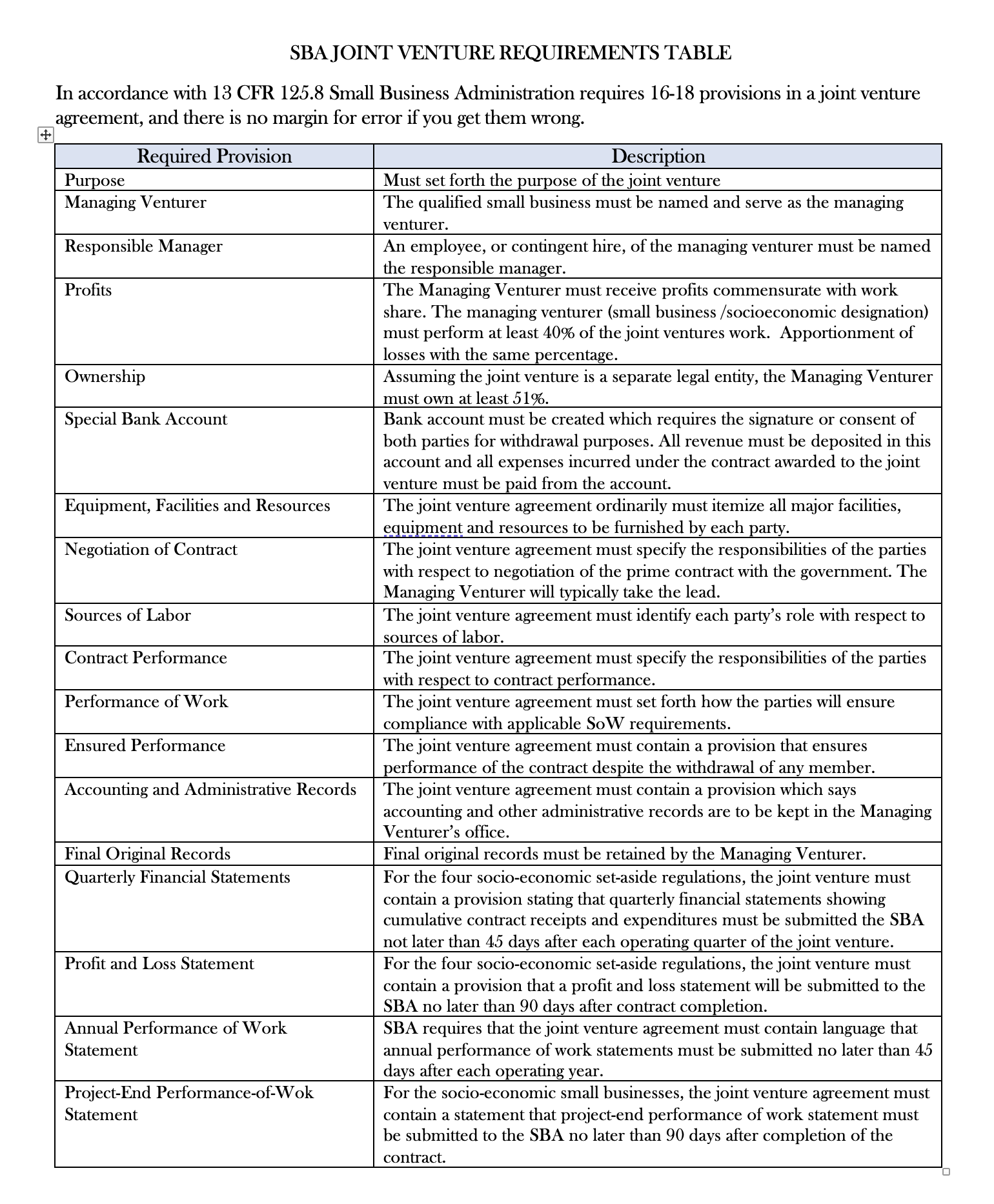

Below is a high-level overview of some, but not all, of the requirements. The table immediately following this essay provides a useful summary, and we recommend that you review both the table and 13 CFR 125.8. While a copy of 13 CFR 125.8 is available for download on our website, please be aware that this version is current as of January 2024. The contents may change, so always make sure you're reading the most recent version of 13 CFR 125.8. Furthermore, we advise against using a joint venture template that is not specifically tailored to these needs. There is no margin for error. Consult with a highly qualified legal professional.

One of the key requirements is the formalization of the joint venture agreement. This document must articulate the joint venture's purpose, detailing each party's roles and responsibilities, with a focus on designating a small business as the managing venturer. This designation is critical because it ensures that the small business has significant control and management responsibilities within the venture, including the appointment of a Responsible Manager to oversee contract performance.

Furthermore, the joint venture agreement must specify the distribution of profits, ensuring that they are proportionate to the amount of work performed by each entity. It is also necessary to open a separate bank account for the joint venture, from which all contract payments and contract-related expenses are disbursed. This ensures financial transparency and accountability throughout the joint venture.

The agreement must also specify the equipment, facilities, and other resources that each party will provide, as well as a cost or value schedule, to ensure that each entity understands its contribution to the joint venture. The agreement also outlines the negotiation responsibilities, labor sources, and contract performance specifics, ensuring that each entity's roles are clearly defined and that the joint venture collectively meets the SBA's work performance requirements.

To ensure compliance and accountability, joint ventures must submit annual performance-of-work statements and project-end performance-of-work reports to both the SBA and the contracting officer. These reports are critical for monitoring the joint venture's adherence to the specified work performance criteria and the equitable distribution of work and profits among the parties involved.

To summarize, the SBA's regulations for joint ventures under the All Small Business Mentor-Protégé Program are intended to create an environment in which small businesses can leverage their collective capabilities to compete more effectively in the federal contracting arena. By requiring detailed joint venture agreements, the SBA hopes to ensure that these partnerships operate transparently, equitably, and efficiently, thereby contributing to the growth and development of small businesses while meeting the government’s procurement requirements.

© 2024, Fed Contract Pros™. All Rights Reserved. The content on this website, including but not limited to articles, images, videos, and logos, is the property of Fed Contract Pros™ and is protected by copyright and other intellectual property laws. No part of this website may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of Fed Contract Pros™, except in the case of brief quotations embodied in critical reviews and certain other non-commercial uses permitted by copyright law. For permission requests, write to the attention of the "Permissions Coordinator" at the address below: info@fedcontractpros.com .

The content on this website is provided solely for educational and informational purposes and should not be construed as legal advice, guidance, or a guarantee of any specific result. The material covered is intended to offer general information on the topics discussed and is not tailored to any specific circumstances or individual needs. Please note that laws and regulations may vary by jurisdiction and are subject to change, rendering the information outdated or inapplicable. Therefore, the content should not be used as a substitute for seeking professional legal counsel. If you require legal advice or services, please consult with a qualified attorney or legal professional in the relevant field.